February 24, 2022

The following was an email sent to SIMSA members on February 24, 2022

Before we dive into economic news, we must first pray for peace and the people of Ukraine. A significant portion of Saskatchewan’s population has Ukrainian ancestry and they helped build our province into what it is today. I think I can speak on behalf of all our membership in saying we support the Ukrainian people. The invasion of their country is a travesty.

Prior to the current events, most of our Saskatchewan companies were and still are experiencing skilled labor shortages. This is a huge issue for our provincial economy and this may be exasperated by the current events. Industries are being effected by record inflation, supply shortages that are going to now get worse, increased cost of energy due to the Carbon tax and world supply shortages. Western Canada is in a strong position to supply energy to the world (if we can get it to port).

The following is a snapshot of Saskatchewan’s potential economic future. This information has a lot of assumptions in it but is our best estimate of the potential – note the words “potential” and “estimate” were used. Given the turmoil of the world today, we can see things can change very quickly.

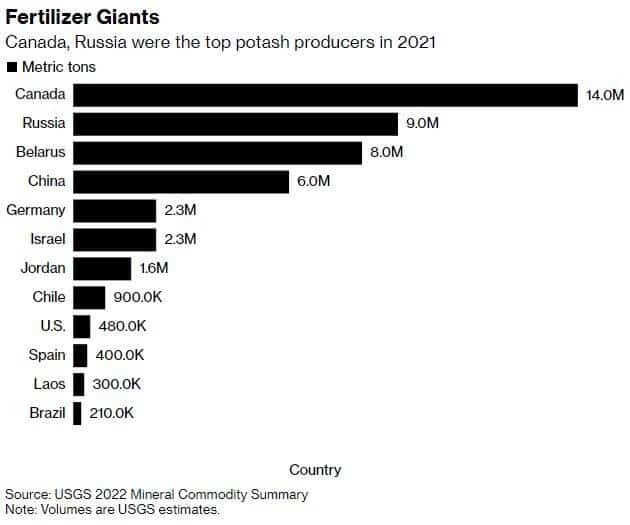

SIMSA is currently tracking $23.293-billion in capital spending – see this document Saskatchewan Opportunites – February 23, 2022. This list is a draft working document that we are asking members to assist with revisions and additions (please contribute). Note, it does not include anything Nutrien, Mosaic, or K+S may announce in the near future, which could happen, given:

- Russia’s movement into Ukraine and Belarus being a staging ground for it

- the two of them produce 34% of the world’s potash

- if sanctions impact this production, Saskatchewan will need to make-up all of the global shortfall

The $23-billion we have listed could create a guestimate of 70,000 jobs direct, indirect and induced – if it all actually went ahead. This stems/is inferred from PotashCorp’s expansions back in 2007 of $4.78 billion, being estimated to create a total of 14,583 direct, indirect and induced jobs at that time. And, this is before Nutrien, Mosaic, and K+S potentially announce anything new stemming from Russian/Belarus sanctions – which are somewhat expected. Even if half of the list comes to be true, we have a labour shortage.

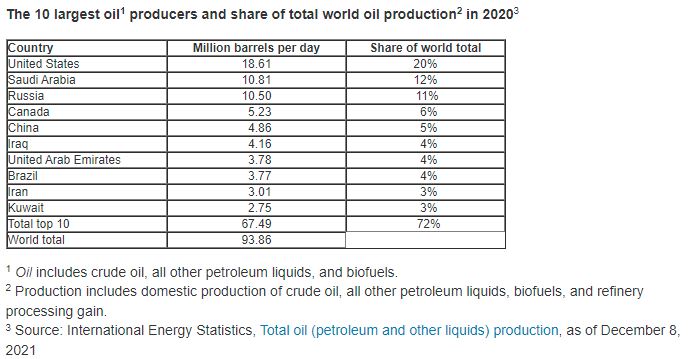

Russia also produces 12% of the world’s oil. Sanctions and economic uncertainty will drive oil prices higher (which has happened already), which then could create more oil production here:

Oil is already at a 7 almost 8-year high – it could go higher (or lower).

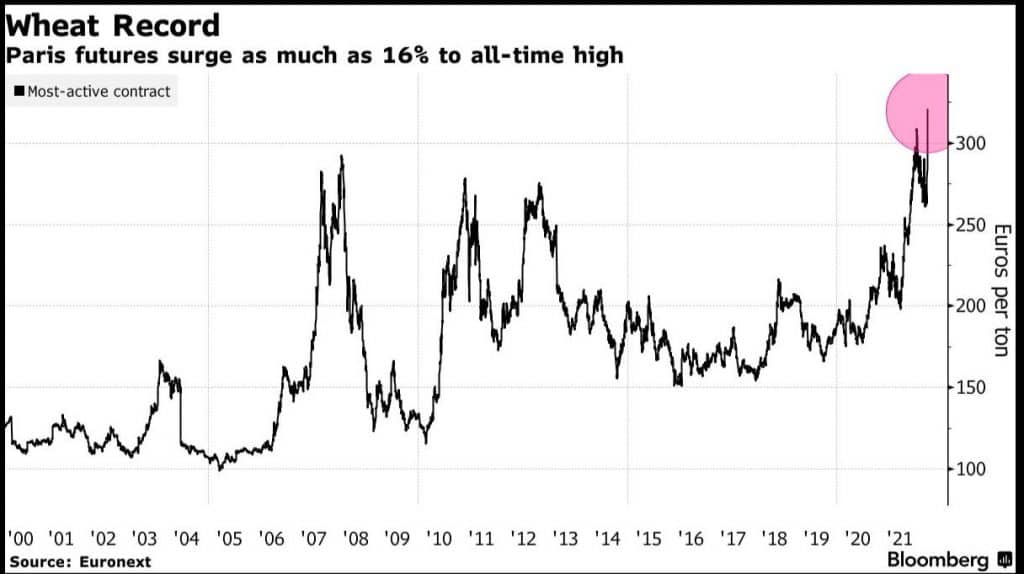

Ukraine and Russia are also major wheat producers. This morning, wheat futures in Paris have hit record highs due to fears and Ukraine port closures.

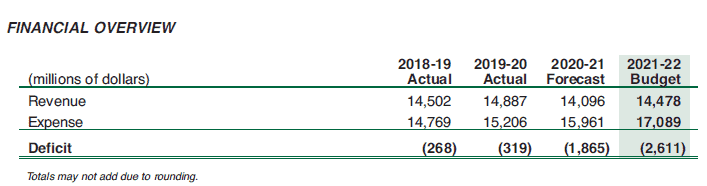

And then there is the potential impact of all of this on our provincial budget. The original budget was for a $2.611 billion deficit (from page 41 of this Saskatchewan budget document):

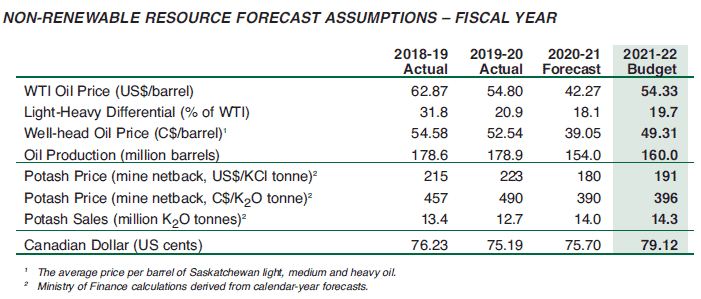

But, that was based upon WTI oil at an average price of $54.33, US$/KCL tonne at $191, and a Cdn dollar at $0.7912 US (see page 45 of budget document):

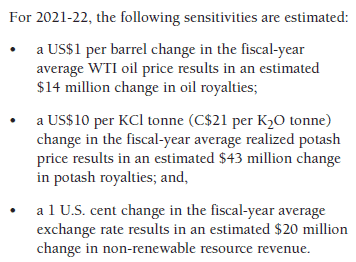

So what happens if prices for oil and potash go up, or production goes up? Well, on page 42 of the budget document you will notice the following:

Note, the above are average prices for the year, but oil is already vastly surpassed estimates and so has potash. In short, the increase will not hit the year-end totals for this budget and may spread into next year, and this is dependent upon prices staying at highs.

Further, you will notice here from February 15 that “Canpotex has agreed to supply China with potash fertilizer shipments at $590 a metric ton through December, which is more than double the price from a year ago and the highest since at least 2013, according to data from Bloomberg’s Green Markets released Tuesday.” And, the Chinese price usually sets the floor/bottom price for the rest of the world’s markets. You will also see here that Nutrien averaged $465 in Q4 2021.

Oil:

- Budgeted at $54.33/barrel

- Today it is at $99.89/barrel

- $45.56/barrel increase over budget assumption x $14-million/barrel budget sensitivity = $637.84 million increase in revenues to our Provincial government (eventually and if prices hold)

- Usually increased prices leads to increased production as well, but currently oil companies are reducing debt and building cash reserves so this will temper new investments. Also, items such as the carbon tax reduces our global competitiveness and reduces enthusiasm. So, production increases will likely be less than normal given increased prices.

Potash:

- Budgeted at $191/tonne KCL

- Today it arguably could be at $600/tonne KCL? (we don’t have nice live-streaming price feeds like we do for oil)

- $409/tonne increase over budget assumption x 0.1 (per $10 change in pricing) x $43-million/tonne budget sensitivity = $1,758.70 million increase in revenues to our Provincial government (eventually and if prices hold). And then, what if we start to produce more? Can or when could we produce more?

There are a lot of assumptions and other variables, but we seem to be potentially drifting towards a balanced provincial budget. And, what if production also goes up – not just prices – the budget looks even better.

All of the above demonstrates we are heading towards a labour shortage, increased work for local suppliers, and an improved provincial budget outlook.

We also pray that things end at economic sanctions.