SIMSA’s Industrial Concierge Service provides personalized advice to SIMSA members, to support; digital innovation, carbon reduction, and ESG initiatives in the supply chain. James Bulmer is SIMSA’s Industrial Concierge.

The Concierge assists SIMSA members in meeting the IMII’s minerals member company needs on:

- Digital transformation

- Carbon accounting, reporting, and reduction

The Concierge service also acts as a connector between SIMSA members and;

- resource producers – relaying industries’ needs as well as SIMSA members’ abilities to fulfill them (especially in the area of digital innovation)

- solutions providers – sourcing leads to 3rdparty solutions for SIMSA members to address industries’ current and future needs (especially in the area of carbon reduction)

- funding agencies – sourcing leads to funding agencies to assist in these efforts.

This service will be completed in concert with the International Minerals Innovation Institute (IMII) and PrairiesCAN.

How Do I Count My Emissions?

To count your emissions, please refer to the Carbon Calculator below. For more information, see below:

Emissions are broken down into 3 scopes: Direct, Indirect and Value Chain Emissions. At the moment, scope 3 calculations are susceptible to double counting or dubious data. Therefore, it is not expected to count scope 3 emissions at this time.

Scope 1 emissions are direct GHG emissions that occur from sources owned or controlled by a company. Scope 1 emissions include:

- Factories

- Facilities

- Boilers

- Furnaces

- Company vehicles

- Chemical production (not including biomass combustion)

Scope 2 emissions are indirect GHG emissions from the generation of purchased electricity consumed by a company, which requires tracking both your company’s energy consumption and the relevant electrical output type and emissions from the supplying utility. Scope 2 emissions include:

- Electricity use (e.g. lights, computers, machinery, heating, steam, cooling)

- Emissions occur at the facility where electricity is generated (fossil fuel combustion, etc.)

Scope 3 emissions include all other indirect GHG emissions occurring as a consequence of a company’s activities both upstream and downstream. They aren’t controlled or owned by the company, and most consider them optional to track. Scope 3 emissions include:

- Purchased goods and services

- Transportation and distribution

- Investments

- Employee commute

- Business travel

- Use and waste of products

- Company waste disposal

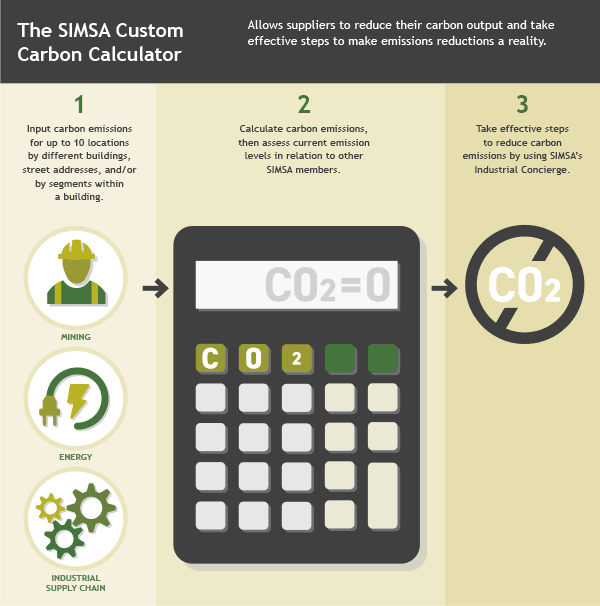

SIMSA commissioned the development of a custom carbon calculator for the mining, energy and industrial supply chain in Saskatchewan—helping lead the charge on carbon reduction.

The calculator allows suppliers to accurately assess their current carbon emissions levels and eventually compare against others (once we gather voluntary input). From there, suppliers can develop solutions to reduce their carbon output and take effective steps to make those reductions a reality, with the assistance of SIMSA’s “Industrial Concierge.” The calculator allows for up to 10 separate locations to be evaluated at once, combining those calculations into one total output. This could include calculating carbon emissions by different buildings, street addresses, or even by segments within a building.

Note, this calculator was built with the Saskatchewan resource sector as its key intended user, so there may be shortfalls in other regions.

The calculator was developed with the assistance of BHP, Cameco, Nutrien, and TC Energy, as well as funding from the Government of Canada.

Calculator Form

Fill out the following form to receive an email with a link to the calculator. The email will also contain a link to an archived instructions session video and a helpful manual.

"*" indicates required fields

The Economics of Carbon

Currently, the carbon tax sits at $52.5/ton CO2 as of 2022, slated to become $178.5/ton CO2 in 2030 (GST inclusive). This means that the carbon tax in real dollars will be:

- Power: in 2022 it is $0.006713/kWh; in 2030 it will be $0.0228/kWh (assuming the electricity mix stays the same).

- Natural Gas: in 2022 it is $0.103 per cubic metre; in 2030 it will be $0.349 per cubic meter

- Gasoline: in 2022 it is 11.25 cents/litre; in 2030 it will be 39 cents/litre

- Diesel: in 2022 it is 13.75 cents/litre; in 2030 it will be 48 cents/litre

One way to understand your total carbon tax obligations is to use our Carbon Calculator and assign pricing based upon the year as follows:

| Year | Tax + GST ($/CO2 Ton) |

| 2022 | $52.50 |

| 2023 | $68.50 |

| 2024 | $84.00 |

| 2025 | $99.75 |

| 2026 | $115.50 |

| 2027 | $131.25 |

| 2028 | $147.00 |

| 2029 | $162.75 |

| 2030 | $178.50 |